The head of the International Monetary Fund (IMF) has warned that a third of the global economy will be in recession this year.

With the US, EU, and Chinese economies slowing, Kristalina Georgieva predicts 2023 will be “tougher” than 2022.

This comes at a time when the world economy is feeling the strain of a number of factors, including the conflict in Ukraine, rising prices, rising interest rates, and the spread of Covid in China.

The International Monetary Fund reduced its forecast for worldwide economic growth in 2023 in October.

We expect one-third of the world economy to be in recession,” Ms. Georgieva said on the CBS news programme Face the Nation.

Hundreds of millions of people “even in countries that are not in recession, would feel like recession,” she said.

Moody’s Analytics economist Katrina Ell gave the BBC her take on the global economy.

“Even though we don’t expect a worldwide economic downturn in the coming year based on our baseline scenario, the likelihood of one is still quite high. However, Europe will not avoid recession and the United States is dangerously close to entering one “…she explained.

In January, China will begin reopening its borders to the rest of the world.

Who or what is the International Monetary Fund (IMF), and why do they matter?

Due to the conflict in Ukraine and higher interest rates as central banks worldwide attempt to rein in rising prices, the IMF lowered its forecast for global economic growth in 2023 in October.

Even though coronavirus infections have been rapidly spreading in China since then, the country has abandoned its zero-Covid policy and begun to reopen its economy.

Ms. Georgieva expressed concern that the second largest economy in the world, China, would have a rough start to 2023.

She predicted that the coming months would be difficult for China, with negative effects on the country’s growth, the region’s growth, and the world’s growth.

There are currently 190 member states of the International Monetary Fund. They’re teaming up to try to keep things even in the international financial markets. An important function it serves is that of an early warning system for the economy.

Ms. Georgieva’s remarks will cause concern amongst people all over the world, especially in Asia, which had a rough year in 2022.

The conflict in Ukraine has been a major contributor to the region’s steadily rising inflation, which has also been felt by households and businesses in the form of higher interest rates.

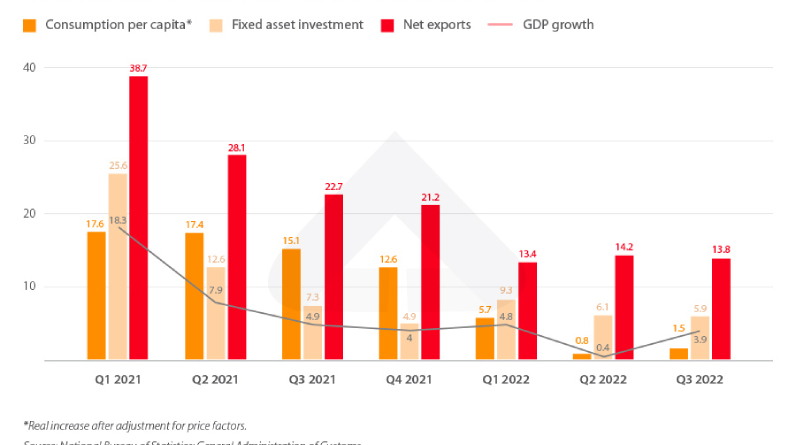

Recent data suggested that China’s economy would be weak by the end of 2022.

As coronavirus infections spread in China’s factories in December, factory activity dropped for the third consecutive month, at the fastest rate in almost three years, as measured by the official purchasing managers’ index (PMI).

China Index Academy, one of the largest independent property research firms in the country, reported a drop in home prices in 100 cities for the sixth consecutive month in the same period.

China has entered what President Xi Jinping has called a “new phase,” and in his first public comments since the shift, he urged greater effort and unity on Saturday.

Also Read :Despite the backlash Madonna reportedly has a deal with PrettyLittleThing a fashion brand

U.S. economic decline has a knock-on effect on the demand for goods manufactured in China and other Asian countries like Thailand and Vietnam.

To compound the problem, companies may be hesitant to make investments in growth if borrowing costs are also elevated.

When investors lose confidence in an economy, they often withdraw their funds, leaving developing nations unable to afford basic necessities like food and energy.

An additional complication of this type of economic slowdown is a currency’s depreciation relative to the currencies of countries with stronger economies.

Increasing interest rates on loans have a trickle-down effect on economies, especially in emerging markets, which may struggle to meet their debt obligations.

China has been an important trading partner and source of economic support for the Asia-Pacific region for many years.

China’s response to the pandemic has already had far-reaching consequences for the region’s economies.

With Beijing’s elimination of zero-Covid, production of goods like Tesla electric cars and Apple iPhones could resume.

Just as inflation seemed to have peaked, renewed demand for commodities like oil and iron ore is likely to increase prices even further.

“Reducing domestic Covid restrictions in China is not a panacea. It’s safe to assume that the transition will be difficult and a source of volatility until at least the end of the March quarter “To paraphrase what Ms. Ell has to say.

The IMF’s warning was “a good wake up and smell the coffee moment,” as put forth by Bill Blaine, strategist and head of alternative assets at Shard Capital.

Despite the strength of global labour markets, he said, “the kind of jobs being created are not necessarily high paying and we are going to have a recession,” so interest rates will not fall as quickly as the markets expect.

That will set off a domino effect of events that will keep markets nervous until at least the second quarter of 2023.

Leave a Reply